What You Should Know About Flood Zone

Flooding is ane of the biggest and worst natural disasters every year, which makes flood insurance an essential protection for many U.S. homeowners. From beachfront condos to landlocked subdivisions, flood zones are in all parts of the land. In fact, almost 41 1000000 Americans live in overflowing zones, according to a written report published in the journal Environmental Research Letter.

Later a record-breaking hurricane season closing out 2020, many people in storm-prone areas are likely to be more mindful of the destruction flooding tin can cause.

Last yr served as a major wake-up call in disaster preparedness. 2020'southward hurricane season saw 13 hurricanes, six of which were classified as major hurricanes. The National Flood Insurance Program, or NFIP, was reauthorized by Congress until September of 2021. Flood insurance claims are an average of $3.v billion each year, and afterward Hurricane Irma in 2017, the NFIP paid out $1.05 billion in claims. Although certain states are more prone to floods than others, it can never be predicted with perfect certainty merely how rainfall, storms or even a rapid snow melt could cause damage from flooding.

Here are five important things homebuyers should know before they buy in a alluvion zone.

one. You might be required to get flood insurance

Those who alive in high-risk flood zones, designated with the messages A or V on a flood insurance charge per unit map or Firm, are usually required by their mortgage lenders to buy inundation insurance. Flood coverage is separate from standard homeowners insurance.

Most homeowners insurance will cover water impairment from a burst pipe, but not heavy pelting, ascent rivers or flooding due to a natural disaster.

Homes located in high-take a chance zones usually crave an acme certificate, or EC. The EC shows what your domicile's elevation is in relation to how high flood waters will reach in the event of a major storm. This gives insurance companies an idea of how much risk is involved, which may affect your premium.

Sellers usually choice up the cost for the EC, which entails a surveyor coming to the holding to measure out the elevation, co-ordinate to Louise Rocco with Exit Bayshore Realty in Tampa. However, if the seller previously had an EC completed, this may exist sufficient.

2. The NFIP can help with some inundation insurance costs, but only if information technology lasts

The outcome of alluvion insurance stood out in stark relief in July 2018 when the NFIP was set to expire. The federal program enacted in 1968 helps offset insurance costs for homeowners who are required to purchase alluvion insurance. Congress passed legislation which was signed by the president, in the eleventh hour, for a four-month extension to the NFIP. Since and then, the NFIP has gone through numerous short-term reauthorizations.

The coverage can exist expensive for people in high-risk zones, which is why the NFIP tin can be valuable to many homeowners.

In Fremont, Nebraska, where the ground is pancake-apartment, many neighborhoods are susceptible to flooding because of extremely irksome stormwater runoff. Jennifer Bixby, president of Don Peterson & Associates in Fremont, says residents depend on the NFIP.

"The federal subsidy programme is what helps keep flood insurance rates affordable. In Fremont, our citizens pay $1 million lone in inundation insurance premiums. If the alluvion insurance program went away, those premiums would go up. That would impact people'south quality of life," says Bixby.

For some, the actress money spent on insurance is not worth information technology.

"A lot of buyers don't want to spend the money on extra insurance. I know one woman who was paying $5,000 per year on flood insurance. You have to make certain you tin afford it and you're willing to pay information technology," says Bixby.

The NFIP is currently authorized through nearly of 2021.

3. Flood insurance is often cheaper outside of alluvion zones

Even if you lot are not required to become flood insurance by your lender, you lot still might want to consider it. For homes that are nigh high-adventure areas, insurance could be a lifesaver.

"Inundation insurance is a deal when you consider the potential loss. Ane foot of water in an average domicile can cause $72,000 worth of damage," says Chris Orrock, public data officer with the California Department of Water Resources.

Pro Tip: Don't wait for an approaching storm to become insurance. Virtually overflowing insurance policies take a 30-day waiting menses before coverage is activated.

NFIP claims by residents who lived outside of those high-chance zones deemed for more than than 20% of all NFIP claims filed. These folks received one-third of federal disaster assistance for flooding.

For people not in loftier-risk alluvion zones, the cost of insurance is likely to be more affordable.

The NFIP'southward Preferred Gamble Policy programme offers depression-price policies for homes that have a low to moderate flood risk. These are designated by B, C or X zones on a FIRM.

"For example, $250,000 worth of coverage, on a house with a basement, costs $386 per yr. For a little more than a dollar a day, this could be the all-time investment you lot make all year," says Orrock.

Flood insurance rates are based on several factors, according to the NFIP, including:

- Twelvemonth of building construction

- Edifice occupancy

- Number of floors

- Location of its contents

- Inundation zone type

- Location of the lowest floor in relation to the base of operations overflowing summit on FEMA flood map

- Deductible and corporeality of building and contents coverage

4. Research local overflowing history before buying

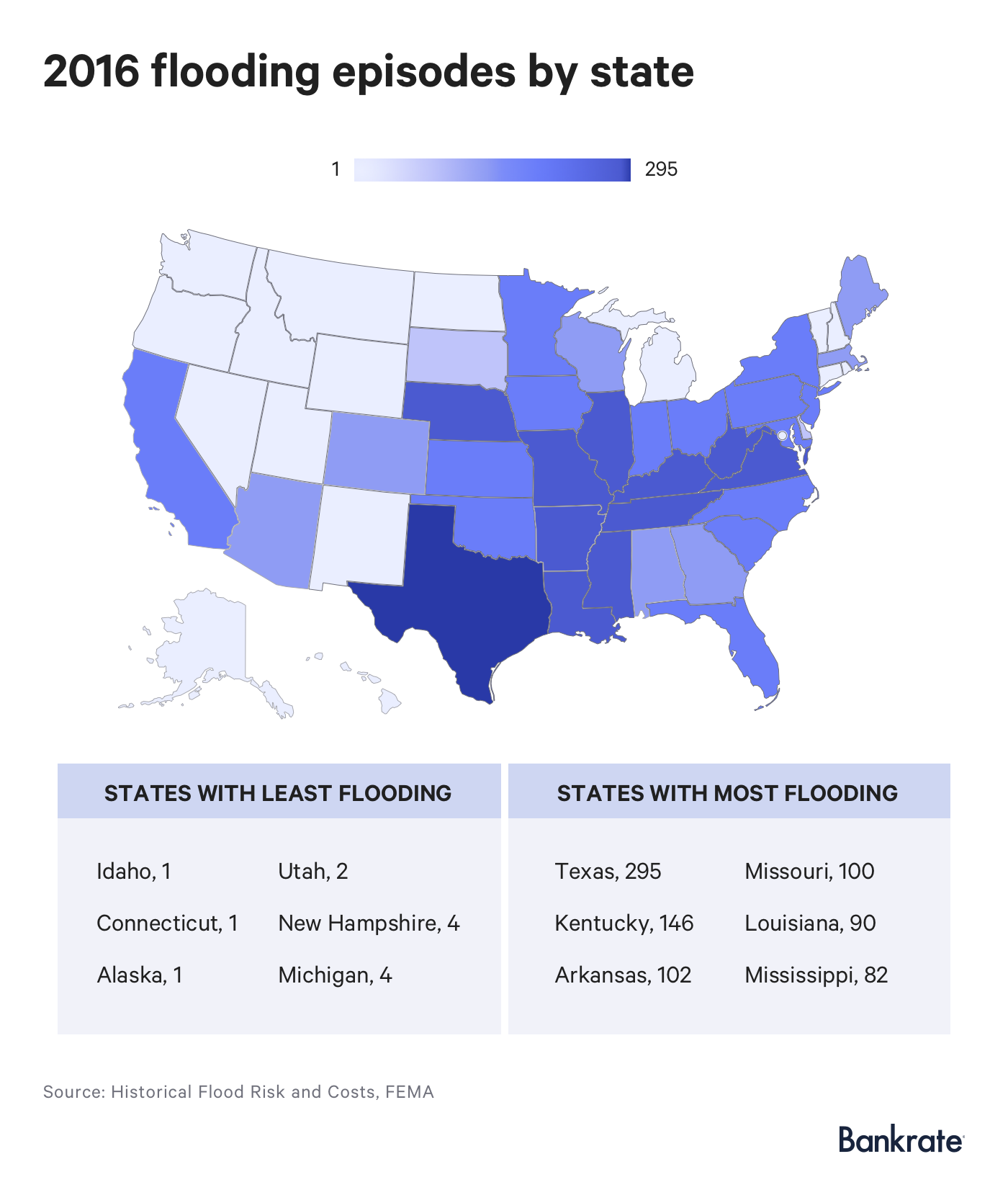

Experts agree that if it rains, it can flood. In fact, 99% of U.Southward. counties have been impacted by a flooding event, co-ordinate to data from FEMA. Fifty-fifty ane of the driest spots in America, Decease Valley, has had dangerous flash floods.

Earlier ownership a home in a flood zone, it is important to sympathise how much take chances yous volition be assuming.

"One of the reasons people buy in Florida is considering they want waterfront belongings and that waterfront belongings is always going to be in a flood zone. And fifty-fifty things that they say aren't in a flood zone still could be. The all-time course of action is to research the belongings yourself and ask lots of questions," says Rocco.

Flood zone information is usually in the MLS listing. Issues similar drainage or flooding problems must exist disclosed.

"Sellers are obligated to disclose information related to flooding, such equally whether or not the property flooded earlier," says Bixby.

People who are in the highest-hazard areas will pay more than for insurance, so this is something to consider when you're firm hunting. Buyers should talk to their lenders near any contingencies associated with buying in a flood zone.

"Some lenders might require you to pay a year'due south worth of flood insurance upfront," says Rocco.

5. Overflowing zone risk levels are not guarantees

Low-risk zones are 10 and C. Sometimes 10 zones will be shaded, which indicates that a barrier, like a levy or dam, has been congenital to reduce the alluvion adventure. Of grade, these structures are not a guarantee that flooding will non occur.

"If you're protected by a levy, even if it meets FEMA standards, there'southward a 25% chance during the life of your mortgage, about 30 years, that information technology will fail," says Orrock.

A and 5 = High risk

D = Undetermined run a risk

B and X (shaded) = Moderate inundation risk

C and X (unshaded) = Minimal flood hazard

half dozen. Learn what it takes to overflowing-proof your dwelling house

If you fall in love with a property, but want to mitigate flood hazards, you can always make changes that will help reduce flood harm. These modifications can exist major structural changes or small tweaks, from putting the structure on stilts to adding physical blocks nether your water heater.

Talk to your amanuensis about negotiating the costs of these flood-mitigating updates with the seller.

"You can elevate the building to make sure water isn't coming in. You lot can even raise it and so that the lowest floor is above flood level," says Nick Ratliff, associate broker with Better Homes and Gardens Real Manor Cypress in Lexington, Kentucky. "These are things you tin can talk to your agent about if yous're in a flood zone."

Depending on your prospective domicile'southward level of take chances, small changes can make a big deviation. A rule of thumb is to make sure h2o is flowing away from the domicile, not gathering in pools.

For example, make sure downspouts are facing away from the structure. Gutter runoff should not collect near the house, which could eventually cause leaks in your basement. If you see this, address it with your agent or the seller.

"Check the pipes and gutters. Make sure they're clean. Place air conditioner units on concrete blocks, to a higher place flood level. This will assist protect your home and appliances," says Rocco.

Frequently asked questions

What is a flood zone?

Flood zones are a style of categorizing areas past the relative risk of flooding. Numerous factors, including terrain, waterways and local rainfall, among other factors, play into a given location's flooding hazard. This ranking organization comes from FEMA and is based on how likely any given surface area will exist flooded in a given year. Sites with a one% or higher are deemed Special Flood Adventure Areas, known as SFHAs. It is not uncommon for higher alluvion chance areas to be both more likely to crave flood insurance and to have more expensive rates for flood insurance. In places where flood damage insurance claims are more common, flood insurance tends to cost more. It's ever wise to know whether or not you're ownership a dwelling within a flood zone.

Is overflowing insurance required?

Flood insurance is required in some circumstances. Most commonly, it is required by lenders for mortgage borrowers. When people take out a mortgage to buy a home that is at high hazard of flooding, the lending visitor may require that the borrower take out inundation insurance on that home. If you need overflowing insurance, you tin talk to the insurance company that holds your homeowner'south insurance policy. If you are trying to figure out how much flood insurance yous might need for your property, consider the Bankrate article, "How Much Flood Insurance Do I Need for a Mortgage?".

Is flood insurance worth it?

Knowing whether alluvion insurance is the right movement for you tin be catchy. In places of frequent flooding, the answer is more likely to be yes, but each property is different. Many structures require flood insurance when mortgages are involved. The best way to answer this question is to learn the risk level of flooding to your property, compare that to the upper limit of damage that flooding might crusade, and then consider how much it would cost to purchase enough inundation insurance to cover that. If the protection offered is worth as much or more as the toll of the insurance, then it may be a good thought.

Does my homeowners insurance policy include flood insurance?

A standard domicile insurance policy does not include inundation insurance. Some insurers offering it every bit an optional coverage but it is e'er sold through the National Flood Insurance Program. You tin contact the NFIP to acquire more near insurance companies licensed to sell inundation insurance policies. Alternatively, some private companies offer overflowing insurance policies every bit well.

Source: https://www.bankrate.com/insurance/homeowners-insurance/things-homebuyers-must-know-about-flood-insurance/

0 Response to "What You Should Know About Flood Zone"

Post a Comment