How Are Bankruptcy Rates of Family Farms Under Trump

Joe Biden claimed that farm bankruptcies increased last twelvemonth "due largely to Trump'southward unmitigated disaster of a tariff state of war." International trade was a cistron, but there were additional reasons that predate the trade war — such as years of relatively weak prices, declining incomes and ascension farm debt, according to agricultural economists and regime reports.

"The defalcation wave this year has roots that go back several years," Chad E. Hart, an associate professor of economic science and crop markets specialist at Iowa State University, told u.s.a. in an email.

The former vice president and presumptive Democratic presidential nominee fabricated his remarks about farm bankruptcies at a "virtual rally in Milwaukee." Biden, who has been staying home in Delaware during the coronavirus pandemic, spoke online to a few Wisconsin Democrats who hosted the online event.

Wisconsin has been reliably Autonomous in recent presidential elections — until 2016, when Trump became the beginning Republican to win the land since 1984. He did and so by less than 23,000 votes, making Wisconsin a key swing state in the 2020 election.

Wisconsin has been reliably Autonomous in recent presidential elections — until 2016, when Trump became the beginning Republican to win the land since 1984. He did and so by less than 23,000 votes, making Wisconsin a key swing state in the 2020 election.

Biden criticized President Donald Trump's treatment of the pandemic, simply said the president's harm to the U.S. economy began long before the health crisis — citing Trump's trade war with China, which began in early 2018 and resulted in retaliatory tariffs on U.S. subcontract products.

Biden, May 20: This crisis hit us harder and will last longer because he spent the last three years undermining the foundation of our economic strength. Subcontract bankruptcies jumped 20% last year due largely to Trump'southward unmitigated disaster of a tariff war.

Biden is correct almost farm bankruptcies, which increased 24% for the 12 months ending September 2019, up to 580 from 468 the previous 12 months, and xx% for the 12 months ending Dec 2019, up nearly 100 filings to 595, according to the American Farm Bureau Federation. The Biden campaign sent us links to the subcontract bureau reports and news manufactures nigh them.

Since those reports, farm bankruptcies accept continued to rise. There were 627 for the 12-month flow ending March 31, 2020, co-ordinate to U.S. Defalcation Courts data.

But John Newton, the farm bureau's chief economist, told us at that place are several reasons for the increase in bankruptcies — not merely the merchandise war. "It'south i piece of many pieces that combined to hurt the farm economic system," Newton told united states of america in an interview.

The farm bureau'due south February study, which Newton wrote, says the increase "was not unanticipated given the multi-twelvemonth downturn in the farm economic system, record farm debt, headwinds on the trade front and recent changes to the bankruptcy rules in 2019's Family Farmer Relief Act, which raised the debt ceiling to $10 million."

The Family Farmer Relief Deed made more agronomical businesses eligible for bankruptcy by raising the limit on debt for those filing nether Affiliate 12 from $four.one 1000000 to $10 million, Newton said. About vii,700 farms take debt in excess of $4.1 million, co-ordinate to a written report last twelvemonth by the nonpartisan Congressional Research Service on farm debt and Chapter 12 bankruptcy filings.

"I don't think it was entirely one issue or another," Newton said.

Newton'south ascertainment is consistent with what we heard from other agronomical economists.

"I agree with AFBF on the bankruptcies," Hart told us in an email. "There are a number of reason why bankruptcies are on the rising. The trade war is role of information technology, but we tin't say that it's the overriding gene. Given farm incomes over the past few years (going dorsum to 2013), we knew the likelihood of more bankruptcies was college, even before the trade fight."

Joseph Glauber, a onetime chief economist for the U.Due south. Department of Agriculture from 2008 to 2014, told us it is impossible to know what acquired the bankruptcies considering so little data well-nigh those farm operations is publicly bachelor.

"I don't think information technology is knowable," Glauber, a senior research boyfriend at the International Food Policy Research Plant in Washington, D.C., said when we asked what was the main factor responsible for the increase. "Were they cotton fiber producers? Dairy farms? We merely don't know annihilation about those farms. We simply know they filed bankruptcy nether a tax lawmaking that is available only to farmers."

Let'southward look at some of the factors that acquired what the farm bureau's October report called a "prolonged downturn in the farm economy."

Declining Income, Ascent Debt

Hart, of Iowa State Academy, said farmers have been in an economic slump since 2014. That's when cyberspace farm income outset started to fall.

Net farm income over the last x years, adjusted for aggrandizement, peaked in 2013 at $139 billion (in 2020 dollars), co-ordinate to USDA data. It declined over the side by side three years, falling to a low of $67 billion in 2016. Since then, it has increased, but not to the 2013 level. It was $87 billion in 2018.

"The farm residual sheet took its biggest hits in 2014 and 2015," Hart said, "and for some farmers, the years since then have been a wearisome erosion of subcontract net worth (debts rising faster than incomes)."

The farm bureau noted that the "farm debt in 2019 is projected to be a record-loftier $416 billion."

Glauber, of the International Food Policy Inquiry Establish, said that farmers "bought tons of equipment" after 2013 in anticipation of connected growth that didn't fully materialize — in part because of domestic and global overproduction — resulting in college debt levels cited in the farm bureau report.

Subcontract debt, adjusted for inflation, has increased every year since 2013, and is now "near the peak levels of the tardily 1970s and early on 1980s," co-ordinate to an October written report by the USDA's Economical Research Service. At the same time, existent estate prices have plateaued in 2014, the study said.

As a consequence, the subcontract sector's debt-to-asset ratio — which is "a measure of a farm business organisation's leverage and is used by lenders equally an indicator of bankruptcy risk" — has been on the rise since 2012, the report said.

Since 2012, "the market for land has weakened and the debt-to-asset ratio has trended upward," the study said. "The debt-to-nugget ratio is now above its 10-year average, though it remains low by celebrated standards."

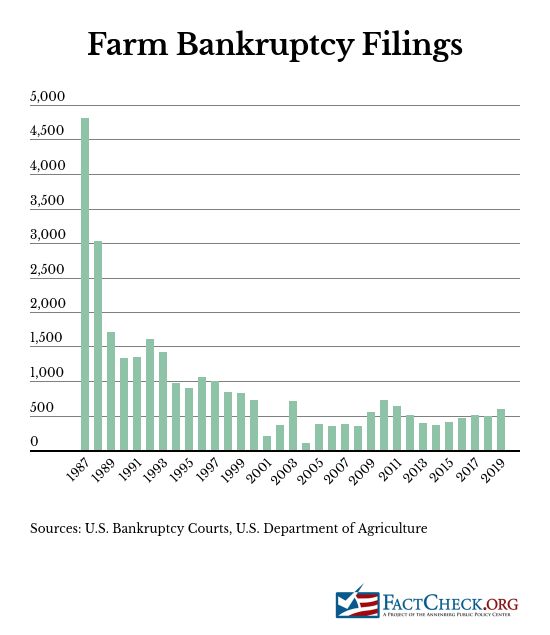

Glauber and Newton both stressed that the current plight of farmers, when put into historical context, isn't close to the farm crisis of the 1980s.

"If yous look at all our reports on bankruptcies, we've indicated that while these bankruptcies are going up they are still well beneath the 1980s — the last fourth dimension we had a farm crisis," Newton, of the farm agency, said.

How far below the 1980s? Every bit the chart beneath shows, farm bankruptcy filings peaked in 1987 at 4,812 — more viii times the 595 filed in 2019 — co-ordinate to a 2004 USDA written report (appendix table 2).

Commodity Prices 'Collapse'

So what has happened in recent years to make farm income fall?

"Commodity prices collapsed in 2015," Newton said.

The impact of the decline in commodity prices was reflected in the annual subcontract income outlook study past the nonpartisan Congressional Research Service for 2017. The CRS study said there had been "three consecutive years of pass up" that was "primarily a result of the significant pass up in most farm commodity prices since the 2013-2014 catamenia." Looking ahead to 2017, the USDA's Economic Research Service projected a rising in net farm income, the CRS report said.

Both soybeans and corn — "the two largest U.S. commercial crops in terms of both value and quantity" — experienced years of high production and stock surpluses that drove prices lower, CRS said in its study.

"For the past several years, U.S. corn and soybean crops take experienced remarkable growth in both productivity and output," the 2017 written report said. "Both crops had record harvests in 2014, above-average harvests in 2015, and record harvests once more in 2016, thus helping to build stockpiles at the end of the marketing year … and pressure prices lower in U.S. and international markets" in 2017.

Internet farm income did rise in 2017, both in nominal and inflation-adjusted figures, but it was still beneath the 2013 level, USDA data show. That continues to be the instance.

In its 2020 subcontract income outlook written report, CRS said commodity prices had been "relatively weak" in 2019 for the "fifth-directly year," again citing "[a]bundant domestic and international supplies of grains and oilseeds" as a contributing factor.

Separately, Hart told us the aforementioned thing.

"Agronomics has seen several years of strong, if non tape, production (the last seven corn and soybean crops have been the seven largest the country has ever had, despite bad weather in some spots), good need (but not quite adept enough to avoid building stocks for some commodities), and inconsistent international trade (mainly driven past ever-irresolute trade policy)," Hart said in an email.

Newton gave the example of soybeans — the top U.South. agriculture export from 2014 to 2018, according to an Baronial 2019 U.S. International Trade Committee written report.

U.Due south. soybean farmers have been hurt past domestic and global overproduction and competition from Brazil, which has expanded its soybean crops, Newton said. In 2018, Brazil surpassed the U.S. as the top soybean producer in the world.

Then, U.Due south. soybean farmers were "crushed" by Trump's trade war with Red china, which had been the largest export market for U.South. soybeans only reduced its purchases by 75% in 2018, the USITC written report said.

"They had had several good years of actually adept crops in the U.Southward. that pushed prices lower," Newton said. "At the same fourth dimension, Brazilian production continued to grow. And then you had a weak Brazilian currency – and so soybeans were already in tough position before [China] put tariffs on them."

The Trump administration, responding to Mainland china's retaliatory tariffs, has created programs to provide direct aid to U.S. farmers.

"Soybeans were really slammed past the tariffs, only at the same time the USDA has dumped a ton of money into the sector," Glauber said. "Is information technology going to the right people? I don't know."

Glauber published a paper in November for the bourgeois American Enterprise Plant that said the administration paid an estimated full of $28 billion compensation to farmers and ranchers in 2018 and 2019. Soybean farmers received 75% of the 2018 payments, merely the formula was inverse in 2019 to provide more assistance to corn, wheat and cotton producers, the report said.

The bottom line: Farm bankruptcies are upward, every bit Biden said. Just the farm economy has been in what the subcontract bureau called a "prolonged downturn" — which predates Trump's trade state of war. That economy has been "made worse by unfair retaliatory tariffs on U.S. agriculture," every bit the farm agency also says.

But none of the agronomical economists that we interviewed could say that the increment in bankruptcies was "due largely" to Trump's trade policies.

Editor's note: Swing State Spotter is an occasional series nigh false and misleading political letters in key states that will assistance decide the 2020 presidential election.

Editor's annotation: FactCheck.org does not accept advertising. We rely on grants and individual donations from people like you. Delight consider a donation. Credit menu donations may exist made throughour "Donate" page. If you prefer to give by check, send to: FactCheck.org, Annenberg Public Policy Center, 202 S. 36th St., Philadelphia, PA 19104.

Source: https://www.factcheck.org/2020/06/examining-bidens-farm-bankruptcy-claim/

0 Response to "How Are Bankruptcy Rates of Family Farms Under Trump"

Post a Comment